Receive up to $26000 per employee in cash refunds

Businesses suffering from economic shocks due to Covid-19 may receive up to $26000 per employee in cash refunds. If you're a business affected by the Covid-19, you can qualify for this Employee Retention Credit.

What is Employee Retention Credit (ERC)?

The Employee Retention Credit or ERC is a refundable tax credit designed to award businesses that retained their workers through the covid-19 pandemic. This is an excellent opportunity for businesses that experienced lowered incomes or shutdowns during 2020-2021.

The ERC is made to provide benefits to both small and middle-sized companies that operated during the pandemic. This tax credit was signed into law under CARES Act 2020 to facilitate businesses to aid in coping with the pandemic-produced losses.

The good news is that business owners whose businesses got hurt by the pandemic may claim up to $5000 per employee in refundable tax credit and up to $7000 for each employee per quarter.

Are You Eligible?

If you are not sure about ERC eligibility and don't know how to determine whether you're eligible for Employee Retention Credit or not. Here's your answer; ERC is applicable for your business if you have experienced:

A Complete or Partial Shutdown of Operations

The companies whose business operations were either fully or partially suspended due to covid-19 on orders from state or federal governing bodies which had authority over employers, travel, commerce, etc.

A Notable Reduction in Gross Receipts

When compared with 2019's quarters, any decline in gross receipts makes the business qualify for Employee Retention Credit. However, note that the decline rate is 50% in any quarter of 2020 and 20% for 2021.

How Can You Claim?

To be able to claim the Employee Retention Credit, estimate your credits and bring down payroll tax prior to the deadline. If you're confused about credit estimation, answer the following questions:

Which category would your business fall into?

In which state does your business operate?

What is the total number of full-time employees in your business?

How to Apply for ERC?

To take advantage of the lucrative tax credit, make sure to follow the steps mentioned below.

Assess to see if your business qualifies for Employee Retention Credit.

Certify the employees that fall into the eligibility criteria.

Certify the employees that fall into the eligibility criteria.

Once the procedure is completed, your credit will be deposited into your company's bank account by IRS.

How To Determine Qualified Wages and Eligible Credits Per Employee?

For the majority of businesses, the qualification of wages and credit per employee is different for 2020 and 2021.

For 2020

Qualified Wages consist of compensatory remunerations given to an employee from March 13th to December 31st, 2020.

For Companies with more than 100 employees, the credit is available for only the workers not providing services.

50% of qualified wages up to $10,000 annually, per employee, equals $5000.

For 2021

Qualified Wages consist of compensatory remuneration given to an employee from January 1st to September 30th, 2021.

For Companies with more than 500 employees, credit is available for only those workers not providing services.

70% of qualified wages up to $10,000 per quarter, per worker equals $21000.

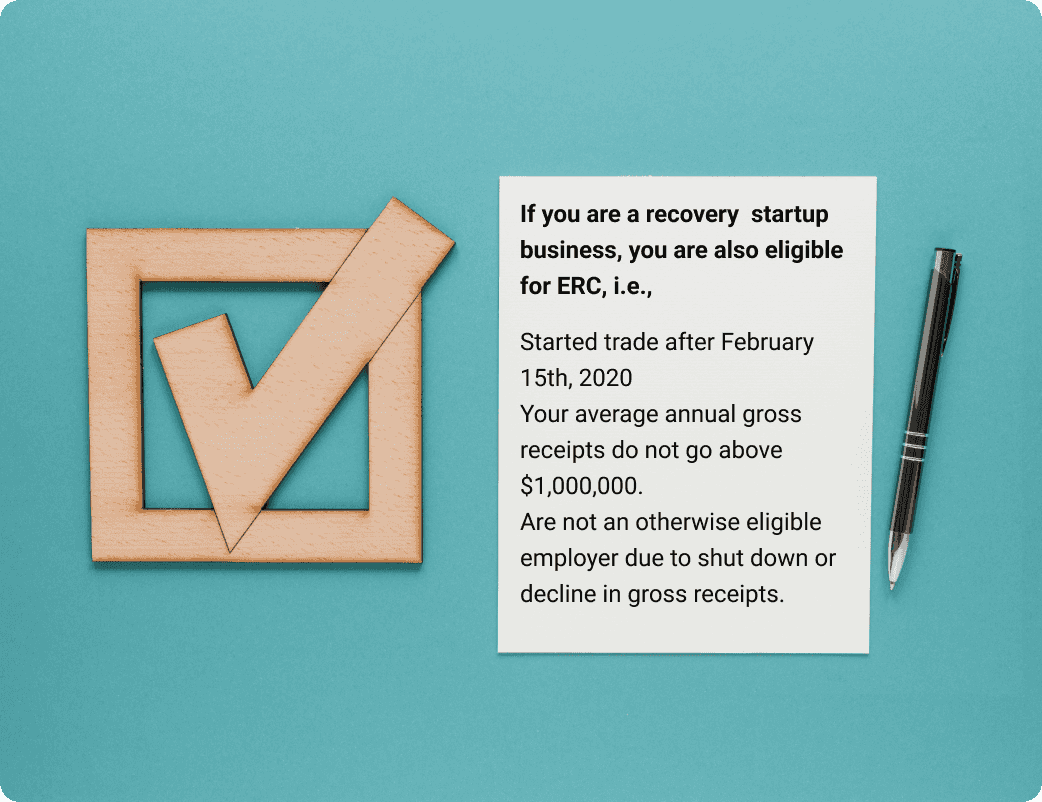

In the Case of Recovery Startup Business in the year 2021

Qualified Wages consist of compensatory remuneration given to an employee from July 1st to December 31st, 2021.

For Companies with more than 500 employees, credit is available for only the workers not providing services.

70% of qualified wages up to $10,000 per quarter, per worker equals $14,000 with a maximum of $50,000 per quarter for the business.

Is ERC considered in the PPP Loan Forgiveness Application?

Yes, PPP borrowers also qualify for obtaining the Employee Retention Credit. However, a bold approach is needed to enhance PPP Loan Forgiveness and utilize the benefits of ERC.

You may apply for a PPP loan simply by following these steps:

Check for your eligibility for the first or second draw of the PPP Loan.

Determine the maximum loan amount.

Collected the required documents.

Look for a PPP Lender to apply for funding.

Frequently Asked Questions

Aggregation Rules Under the Employee Retention Credit

Is your company a part of a controlled group? Don't worry. You may still qualify for the Employee Retention Credit. All entities that are participants of a controlled team for functions of the ERC need to be accumulated for the following objectives: Determining whether the company has a trade or service operation that was totally or partially put on hold because of orders connected to COVID-19 from a suitable governmental authority. If one member of the group was shut down, the whole team may declare an ERC for the period the business was suspended.

Identifying whether the company has a substantial decline in gross receipts. Gross receipts of all members must be incorporated to establish if there was a certifying decrease in gross invoices.

Determining whether the employer has greater than 100/500 permanent employees.

Figuring out the optimum credit rating quantity per employee.

Once it is figured out that an aggregated group receives the Staff member Retention credit history, the amount of the Staff member Retention Credit report has to be apportioned amongst members of the aggregated group on the basis of each member's proportionate share of the certified incomes giving rise to the credit.

Note: Even if a certain staff member works for greater than one firm in an associated group, that staff member's wages might only be counted among the companies when establishing "certified earnings"Which Companies Fall Under Controlled Group Rules?

If you lie within any of these three categories, special controlled group rules will be applicable to you. Existing within any of these will impact your ERC amount and utilization.

- Parent-Subsidiary groups

- Aggregated Groups of Corporation

- Brother-Sister Controlled Group

Aggregation Rules for the ERC

If your business falls in the above-mentioned categories, you and other employers will be held as a single employer during the application of ERC regulations for qualification. Consider all companies as a whole to determine if you meet the eligibility criteria collectively. Thresholds for qualified wages will depend on the collective full-time employee count across the combined companies. An eligible employer must have:

- Undergone partial or full suspension of business operations due to the pandemic.

- Experienced a considerable reduction in gross receipts.

Is Employee Retention Credit really worth it?

Yes, ERC is worth the effort you put in. There’s a lot of money in ERC, and the companies should definitely claim it. You could be eligible for up to $5000 in the year 2020 while $7000 per quarter in the year 2021.

How long does the ERC procedure take to fully complete?

You can easily find out within minutes if you’re eligible to proceed with ERC. This article will help you easily determine whether you qualify or not. Once you’re done, expect your refunds about 6-10 months from the date you filed.

If the PPP loan is forgiven, can I still qualify for ERC?

Yes, you can still apply for ERC. However, the credit will be reduced by the amount of PPP forgiven by employees.

Who qualifies for the Employee Retention Credit?

Companies that experienced partial closures as a result of government orders restricting commerce, travel, or group conferences; or that seasoned substantial declines in quarterly gross invoices (as compared to their quarterly gross invoices in 2019) due to the pandemic are eligible companies under this program.