R&D Tax credit for startups

Every fiscal year, the government of United States provides innovative businesses with billions of dollars enabling them to develop new technologies, as well as improve existing product processes, technologies, and materials. All of this happens under the US Research and Development (R&D) Tax Credit program.

What are the tax credits available to U.S. startups?

The R&D Tax Credit allows startups to claim a proportion of their development expenses provided that they qualify with the eligibility criteria. Employee payroll tends to be one of the biggest costs categories. The proportion of their salary that can be apportioned as R&D-related depends on the nature of work that the employees in question are performing, and the time they're actively spending on the R&D tasks. To know the correct percentage, it is best to work with a specialist or your accountant.

As an example…

Let's say that an engineer spends 70% of their time on tasks related to R&D (meaning that 70% of their paid salary is just dedicated to Research and Development). In comparison, a salesman in the initial stages of a company dedicated 10% of their time to the work, as in those stages, even the salespeople help with customer research and product management).

The main purpose of the tax credit is to purely invest in innovation and help promote and establish it. In the last few years, Congress has made sure that these companies get the tax credit that they're owed as it will give these startups the pathway that leads to products and ideas that are valuable and innovative.

What is R&D tax Credit?

If you are still confused about what Research and Development tax credit or R&D tax credit is, then it is simply taxed legislation that was passed so that American companies are incentivized to invest in new and innovative products and results. It is truly a tax solution for small/mid-sized businesses tax and startups that suffer from the costs of research and development. Its intention is to encourage innovation, development, or improvement by allowing American countries to claim their respective amount tax credit for their qualified research expenses.

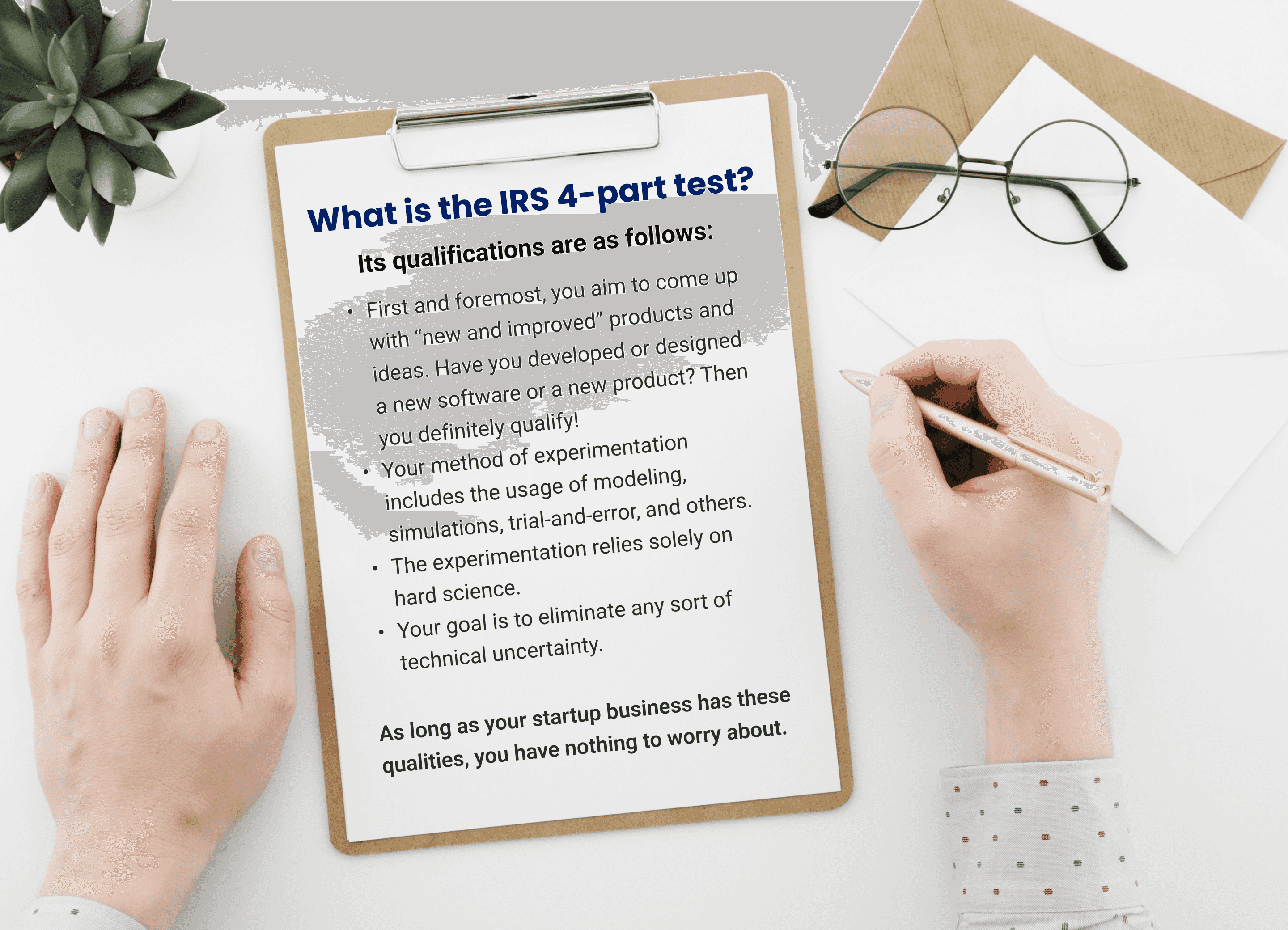

Is your small or startup business qualified?

Firstly, your Startup business should be in its early stages, so much so that it only has 5 fiscal years or less of generated revenue can claim the recent tax credit. If your tax credit receipts are dated before 2012, then you are automatically ineligible. To qualify for it now, your company, in 2018, should have $5 million or less in revenue. Other than that, IRS 4-part test is a good way to determine who is eligible for the R&D tax credit.

How much credit can a startup use?

As for the credit, a startup can claim up credit worth $250 000 in the payroll taxes. If Gusto's client has AvstractOps as their payroll provider, then the credit can automatically be applied against each payroll. If they use some other provider, then the disbursements they receive would be quarterly from the government. However, once it is claimed, the government mostly always signs it off. If you're wondering when this r&d tax credit calculation begins, then it is from day 1 of the consequent calendar quarter.

How does the R&D tax credit pricing work?

For businesses that qualified for it, an R&D tax credit for startups usually works up to be 10% of the qualified expenses. For instance, if a business spent $2.5 million on r&d, the respective r&d tax credit to offset payroll taxes would be about $250k. Sometimes, it can be very tricky and confusing to understand what the true cost can be of having someone else prepare the R&D tax credit filing for you since some of these preparers tend to charge based on %, while others take it as a % of the credit value itself. So, if someone were to charge 3% of the expenses, it would work out to be 30% of the credit. Similarly, if someone were to charge 1% of the expenses, then that would work out to be 10% of the said credit.

Why these framings differ isn't always reprehensible, while some companies may try and frame to seem affordable by pricing as % of the expenses. Seeing as the IRS even has established a rule against what's called “contingent fees.”

Technically, an R&D preparer can't really promise that they will know of a % only when the credit is granted. Therefore, when companies frame their pricing around the qualified expenses instead of the credit itself, it saves them from the pitfall of these contingent fees. As for the customers, what needs to be remembered is that they need to check the metric that they are using for understanding the true cost of their credit!

What makes a startup miss its non-dilutive funding opportunity?

If you think your startup deems eligible for the r&d claim but still keep missing out on the money that you have earned, then there can be a number of reasons:

Your business didn't produce any or any revenueAs mentioned before, your startup must have at least $5 million worth of revenue. If your startup does not demonstrate the income that qualifies for this, then you can't really avail it.

It's too complicated!Some people assume that this whole process is too complicated simply because it is too good to be true, but that is certainly incorrect. If you have successfully understood and passed the eligibility requirements, know the benefits of this tax credit program, and how to maximize this credit, then avail of it.

No enough researchPerhaps, you think your company needs scientists running around the lab in their lab coats, but that is but a misconception.

Not that great a successYour business also doesn't need to be successful to be qualified. If anything, this r and d tax incentive should lessen the burden of no return on investment, which usually happens with riskier businesses. Consequently, the more you push forwards on bringing about innovative solutions and ideas, even with technical challenges, the more reward you. Basically, the effort is what makes your business eligible, not the success!

Maybe, it's the lack of development?We know by now that the whole point of this tax credit includes the development or improvement of the design and innovative product process, formulae, ideas, software, and much more. If your company simply doesn't aim to do it, then it can be hard to avail this opportunity.

As an incentive taken by the government, the R&D tax credit for startups is an opportunity that no one should miss out on since it's simply to aid your business' r&d activities. Although it may seem intimidating, it is not as complicated. All you have are a few steps to follow and pass, after which the way is only forward for you. Contact us to determine your eligibility for the program and make an application.